When Matteo Quacquarelli, Vice President of Strategy and Analytics at QS, wrote for HEPI in May 2024, he presented student enrolment data from our university partners to identify a few trends in the 2024 recruitment cycle. As of 21 May:

- Offers accepted were down year-on-year overall.

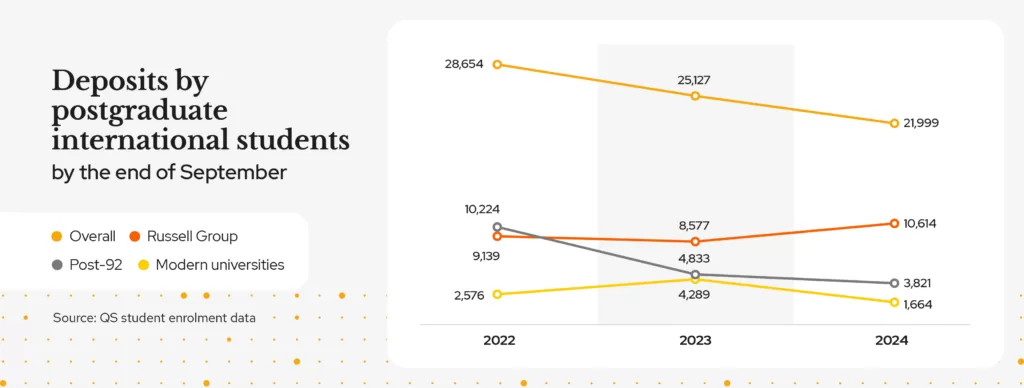

- Post-92 universities and modern universities had far fewer deposits made, while the Russell Group saw an increase year-on-year.

- Russell Group partners saw renewed demand from China, while post-92 and modern universities saw substantial decline in Indian and Nigerian postgraduate student interest.

At that time, Matteo’s summary was that the profile of growth within UK higher education had shifted more favourably towards the Russell Group of universities, with China – a market known to prioritise prestigious universities – being the main driver of growth. Has that trend changed since May, with recruitment (mostly) over for 2024? In a word, no.

Precipitous drops

As of the end of September, overall demand is down year-on-year across our student enrolment partners, demonstrating a sincere challenge facing universities. Acceptance and deposit rates are down 19% and 12% respectively year-on-year, which will undoubtedly result in a lower enrolment rate. Deposits have dropped by 23% since 2022.

As we suspected in May, most of this reduction is seen among post-92 and other modern universities, and, indeed, this is, mostly, because the number of Nigerian students depositing has severely diminished.

At post-92 universities, we saw deposits from Nigeria fall by 40% year-on-year, and there was already a massive 82% decline from 2022 to 2023. Modern universities have not fared much better – after a near-80% increase between 2022 and 2023, 2024 saw a 59% decline in Nigerian student deposits compared to the previous year.

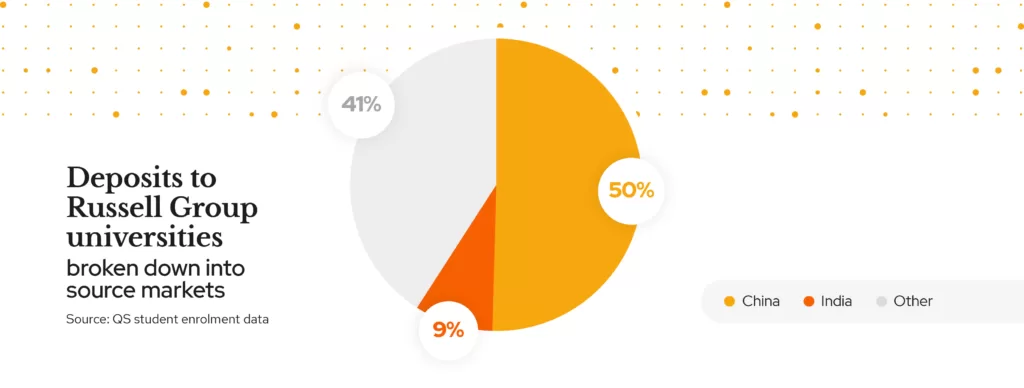

It’s a brighter picture for the Russell Group. They saw upward trends across their overall demand, and accept and deposit rate, primarily driven by students from China and, to a lesser extent, India. Deposits from Chinese students were up 39% year-on-year, while deposits from Indian students were up by 22%.

Risks and opportunities

Undoubtedly, the picture is worrying for post-92s and modern universities. Funding has been a concern for a long time for the UK sector, and a drop in international enrolments will only harm any hopes of recovery or rejuvenation for many universities.

Russell Group universities are not without risk, though. The Russell Group’s increasing reliance on India and China to provide student volumes has meant a large portion of their enrolments have been at risk of geopolitical changes and other external forces for some time now. There is also increasing demand for international students across the UK and in the US, Australia, Canada and New Zealand, all leading to competition that’s fiercer than ever. Domestic universities are also becoming ever more appealing, particularly with the inflated cost of living in the UK. The improved performance of universities in India and China could also reduce the number of students seeking international study.

There are opportunities too. Regardless of classification, African markets are increasingly active according to student enrolment data from our UK partners – though none so active as Nigeria was in 2022. Students in Senegal, Sierra Leone, South Africa, Uganda and Zimbabwe all hold more offers in 2024 than previous years, suggesting that they’re increasingly seeking study in the UK.

Recommendations

Now is the time for action. The UK, with its longstanding reputation for high-quality education, is in a good position to take advantage of market disruption in Australia, and potentially in the US. Now, universities in the UK need to make the most of this opportunity.

Continue investment into employer and academic reputation

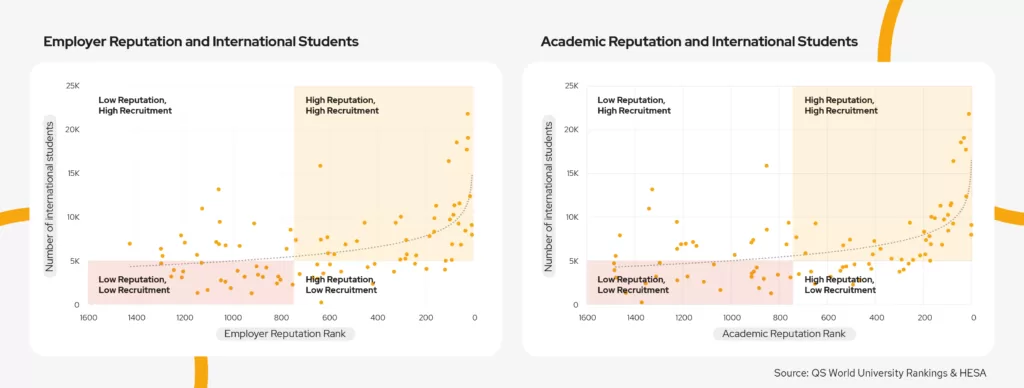

Reputation among employers and academics can feel far removed from student recruitment, but there is a correlation.

Nurture academic and employer contacts and encourage your own academics to be a part of this process. Ensuring key stakeholders know about your recent research and other achievements is a surefire way to drive reputation performance.

Diversify your revenue streams

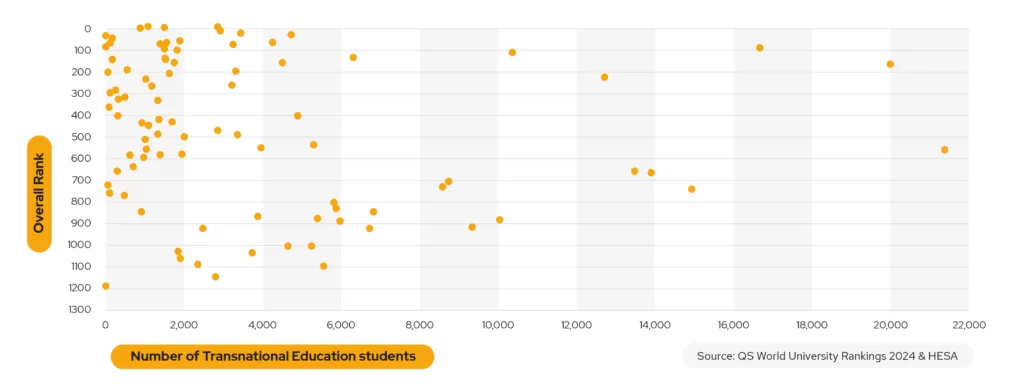

Transnational education is of increasing interest to UK universities.

The strength of the UK brand makes TNE a more viable opportunity for all UK institutions, regardless of their position in the ranking. The chart above shows that the number of TNE students is not directly correlated to overall QS World University Rankings position. 38% of TNE students at UK universities are at institutions which aren’t included in the rankings.

Focus marketing based on student motivation

With QS 360: Student Recruitment, you can identify personas of students based on their chosen course. This means you can build a marketing plan around the ambitions and motivations of your student personas, and reach them with messages that truly resonate.