We live in data-rich times. At QS, we capture over one billion data points – universities, governments, third-party providers provide more besides. Without proper guidance and expertise, it can be a challenge to know what metrics matter, and how to cut through the noise. At the BUILA Conference 2024 on the 9th July and during a recent QS webinar, we explored exactly what UK universities can do to build a data-led international student recruitment strategy.

Step 1: Understand the trajectory

Data gathered prior to the UK government confirming that the Graduate route visa wouldn’t be changed showed that students were directly impacted by the uncertainty. According to the QS Country Perceptions Survey 2024, 24% of prospective students were less likely to consider the UK because of any potential changes.

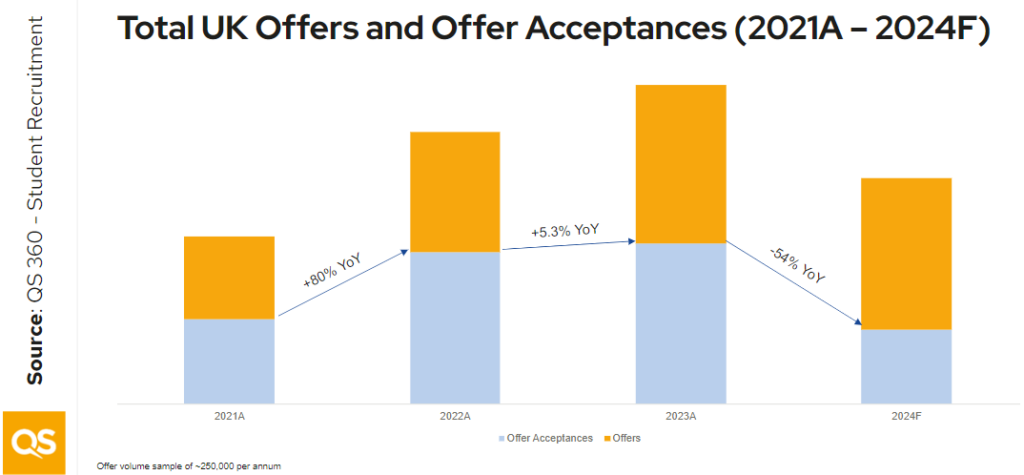

The impact of this hesitancy will be felt in September 2024’s offers and acceptances. With QS 360’s forecasting, we estimate that offer acceptances will be down 54% year on year.

However, as Matteo Quacquarelli, Vice President of Strategy and Analytics discussed in a recent HEPI article, offers are down, but Russell Group universities are faring better than their peers.

QS 360 is our new analytics and advisory solution for student recruitment. With it, we can look forward, and model future results for universities. QS 360 forecasting suggests that Russell Group universities will have increased their share of offer acceptances by 23% YoY. Out of the top five source markets for UK universities, only China is expected drive growth in 2024, with offer acceptances tracking to be up 25% YoY. Chinese students are far more likely to enrol at Russell Group universities than other university types, so Russell Group performance is primarily due to the return of the Chinese student market.

Step 2: Assess the risks and opportunities

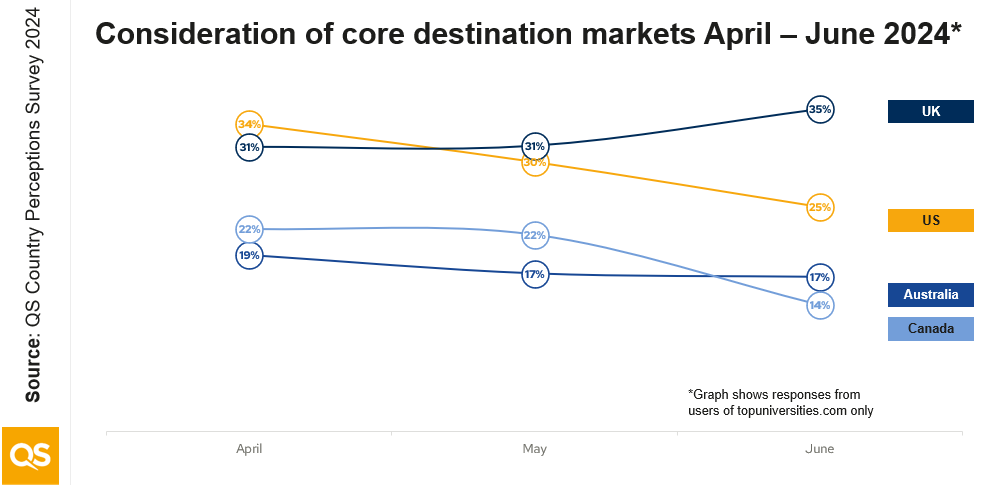

When it was confirmed that the UK’s Graduate route visa would not be changed, perception of the country improved, at the expense of competitors.

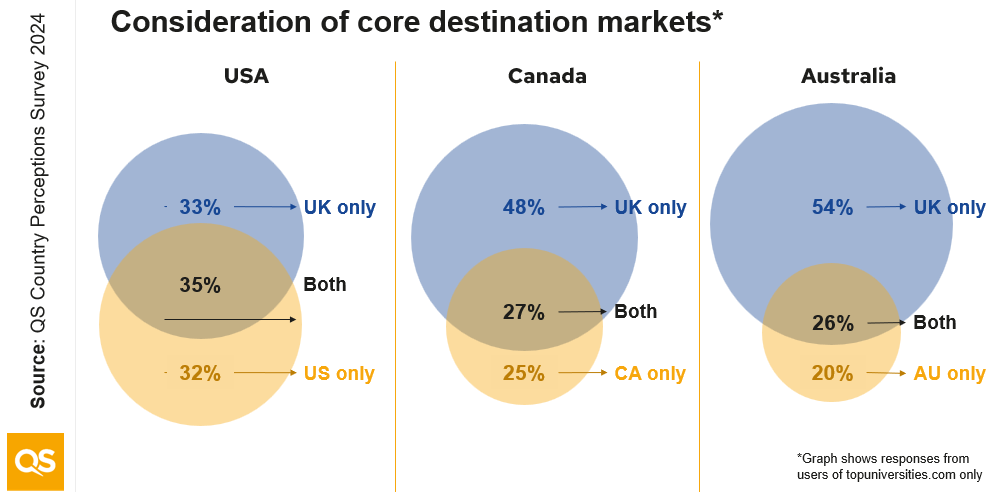

The relative speed with which the popularity of the UK has rebounded as a study destination reiterates the resilience of the sector and suggests the impact these discussions had will be short-lived. This is key, as competition for international students is fierce, and a third of prospective students considering UK study are likely to be considering multiple study destinations.

Perception is positive

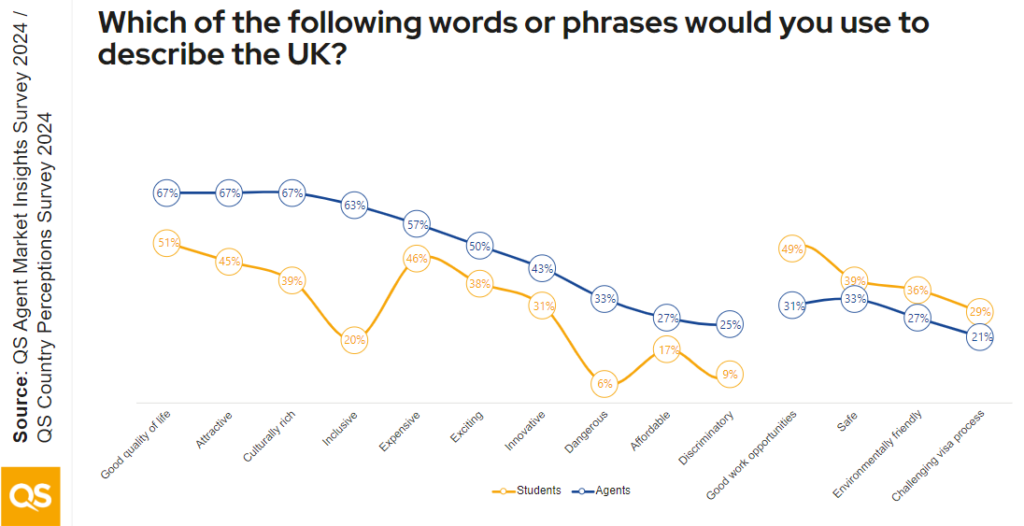

When we analysed data from the QS Country Perception Survey 2024, we found that the UK’s image as a study destination is unaffected by uncertainty, with it still being seen to offer a good quality of life and work opportunities.

This positive perception is seen more strongly among education agents. Agents recognise the diversity of student communities, but students are more likely to focus and identify the work opportunities available to them.

According to data from the QS Agent Market Insights Survey 2024 and the QS Country Perceptions Survey 2024, the UK is perceived as the most welcoming destination for international students by students and agents.

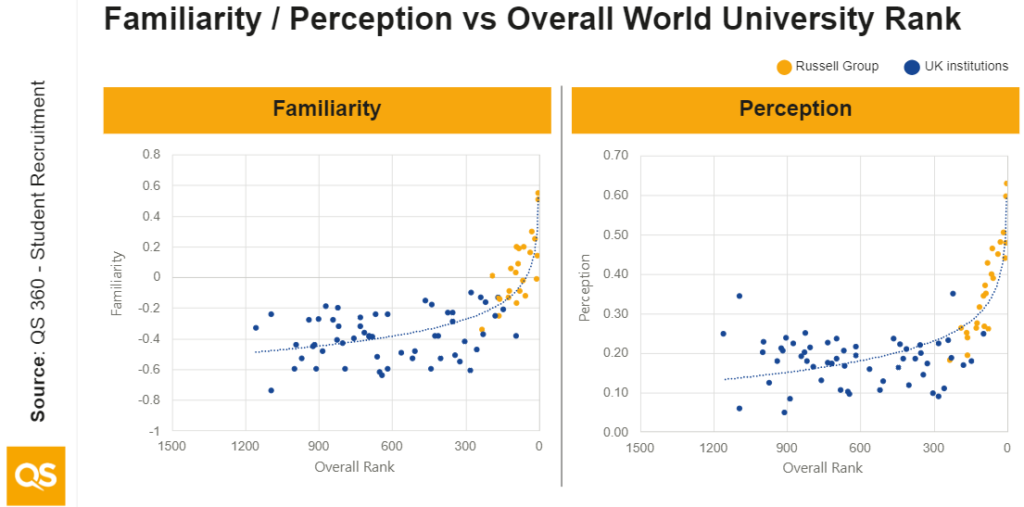

Further emphasising Matteo’s point in his HEPI article, universities with a better perception than their peers and a higher relative position in the QS World University Rankings will rebound fastest. For the UK, this primarily means the Russell Group universities.

Step 3: Act to make impact

Now we better understand the UK higher education market; it’s time to act. Our advice? Isolate the levers that matter.

Widen your addressable market – diversify your revenues

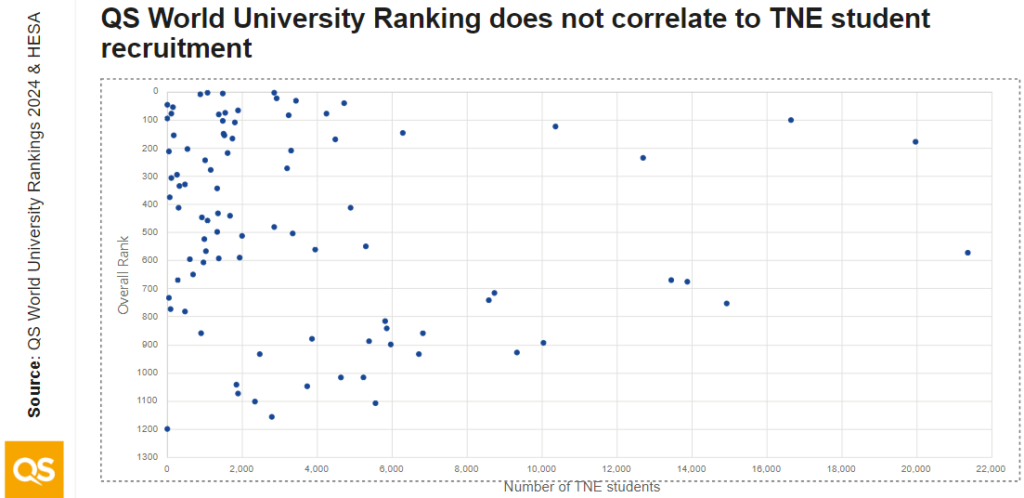

The strength of the UK brand makes trans-national education (TNE) a more viable opportunity for all UK institutions, regardless of rank and perception. There is little correlation between an institution’s performance in the QS World University Rankings, and TNE student recruitment – 38% of TNE students at UK universities are at institutions not included in our rankings.

Price flexibly

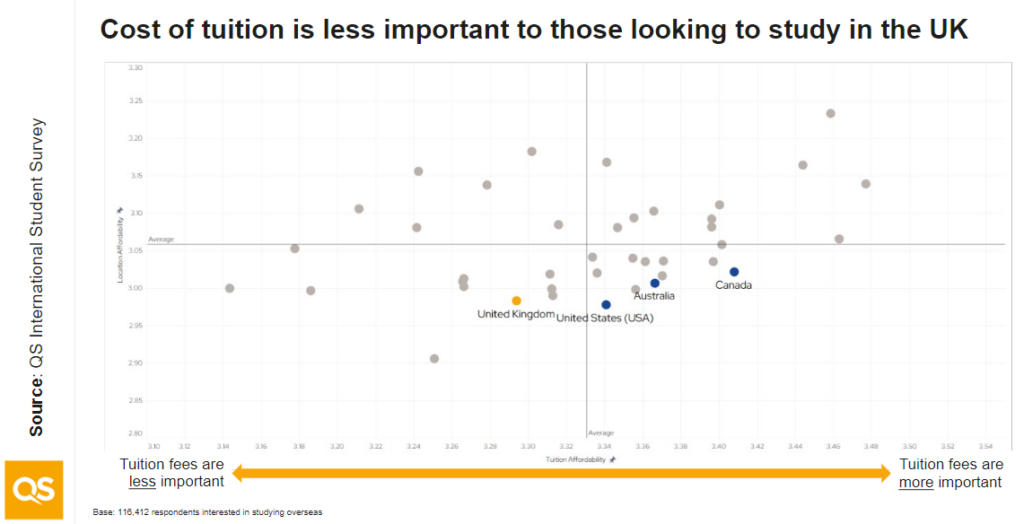

The cost of tuition is less important to candidates looking to study in the UK, compared to those looking to study in the US, Australia and Canada. This presents an opportunity for UK institutions to introduce more flexibility into their pricing models.

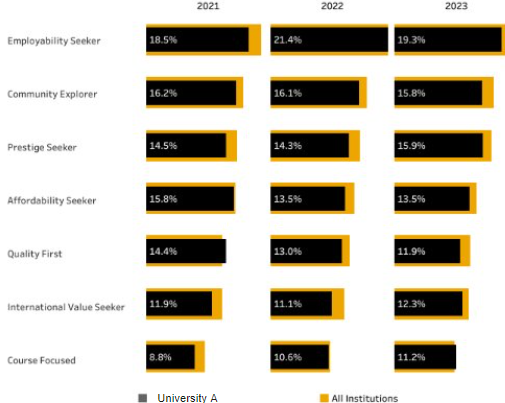

Prioritise an engagement and marketing plan built around the ambitions and motivations of your student personas

UK universities have seen an upward trend in employability and community focused students. With QS 360, you will be able to see the ambitions and motivations of different student personas. You can then use this information to tailor your offering depending on the market you’d like to recruit from. This ensures students receive an education that prepares them for the future job market, and increases their course satisfaction.

Plan for different scenarios

Our mean forecasts – powered by QS 360 – indicate a potential 10% decrease in offer acceptances for UK universities in 2025. For a robust strategy, you must understand the implications of different planned events on your spend.