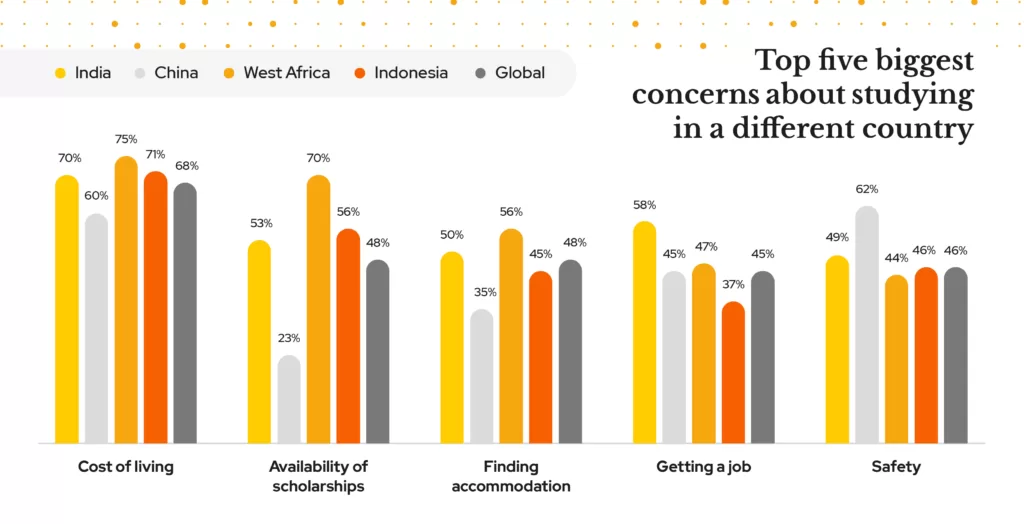

Though cost of living is a concern globally, preferences and concerns differ among students from key source markets.

In the QS International Student Survey 2024, we gathered the views of over 140,000 prospective international students to truly find out what’s important to them. We ask them a suite of questions, and use their answers to empower institutions to make strategic decisions.

Alongside the QS Student Insights Tracker, where you can access the full dataset, we provide free reports based on the top source and destination markets. What’s clear from these reports is that while there are preferences that are similar across various source markets, a one-size-fits-all approach is insufficient when trying to diversify student cohorts.

Cost of living a global concern, but other factors causing worry

For almost all of these large source markets, cost of living is the biggest concern – Chinese students are the exception, with their largest concern being around safety.

This aligns with these markets’ reported household income. Significant proportions of students from India, West Africa and Indonesia said they had a household income of under USD$25,000. This also explains the importance placed on scholarship availability by students in those markets. As we wrote in the report based on Indian student perspectives, ‘With the increased cost of living and studying in major destination markets like the UK, US, Canada and Australia, universities must show how a degree results in a strong return on investment’.

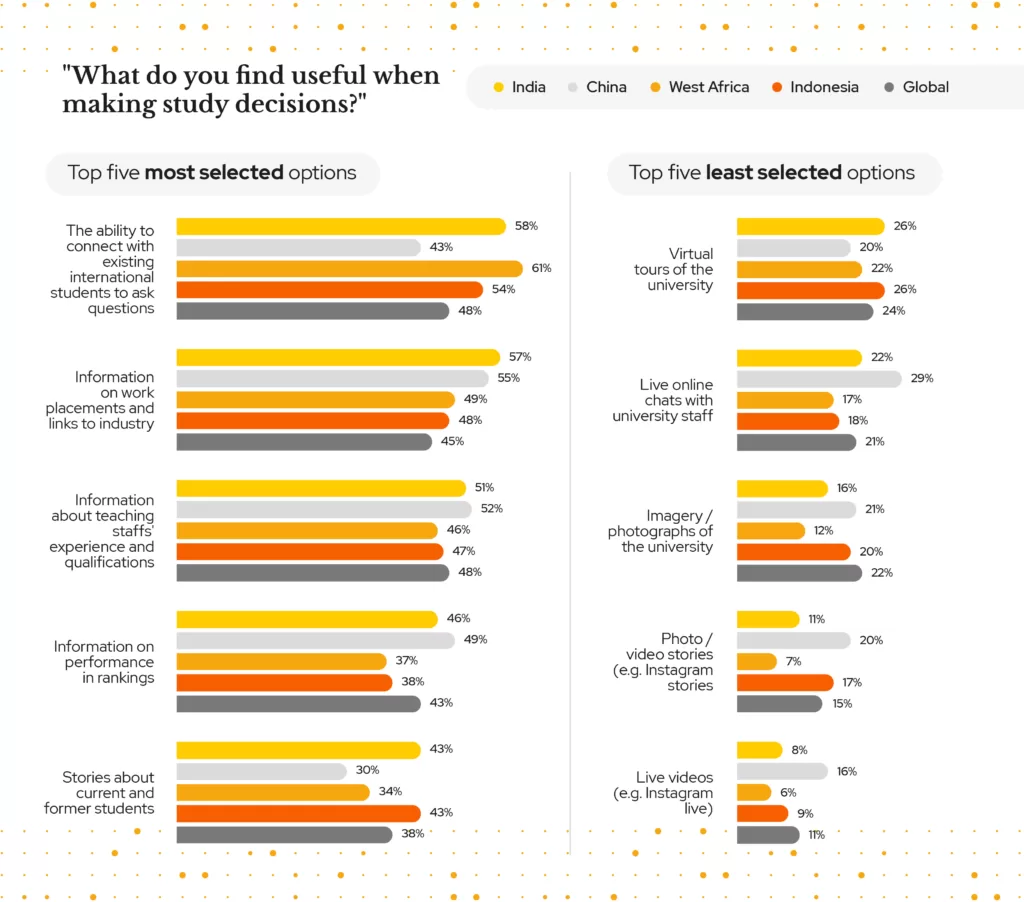

What do students find useful when making study decisions? What’s not useful?

Over 50% of students from Indonesia, West Africa, India said connecting with existing international students to ask questions was useful when making study decisions – far more than the global average, and, indeed, Chinese students.

Chinese students find stories about current and former students less useful than Indian and Indonesian students, reinforcing the lack of importance placed on student testimonials. Chinese students find rankings and information about work placements more compelling.

At the other end of the scale, few students find live videos or social media stories useful. Even virtual tours or live online chats – which are large time and financial investments for some universities – are not seen as useful.

Reassuringly for universities, there is a general global consensus in what students do and do not find useful. While their relative importance differs, if universities can cover these bases in their marketing materials – or make the information easy to find – they should be delivering the information students find useful.

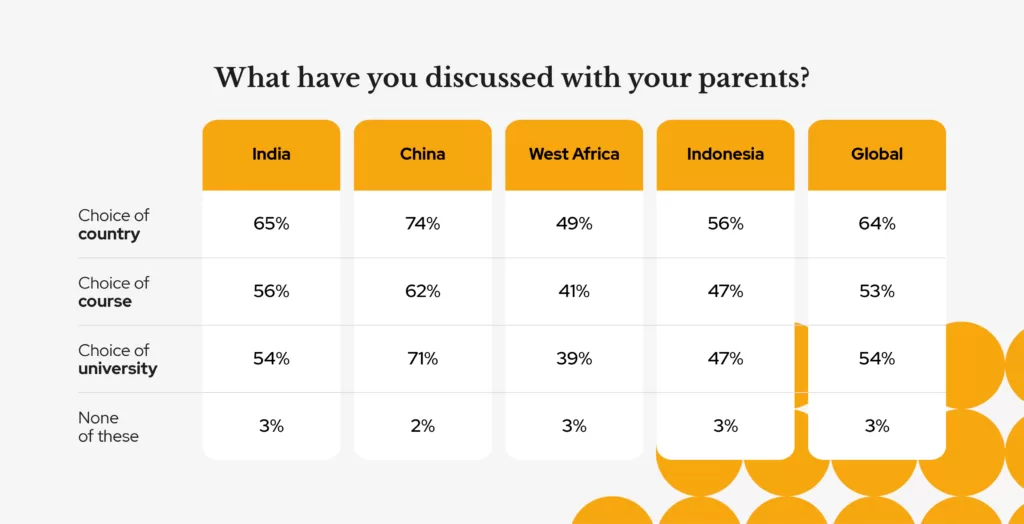

Parents consulted the most by Chinese students

Chinese students continue to be the most likely group to discuss choice of country, course and university with their parents. As noted in From China to the World, this doesn’t impact the amount of influence parents have, with 22% reporting that parents had a lot of influence – only 2% higher than the global average. 81% of Chinese students said parents or family will be their main source of funding, far higher than the global average (43%).

Regardless of the influence reported by students, it’s clear that parents are a key stakeholder in international student recruitment. Consider how you are targeting parents and re-assuring them with resonant messages – particularly around safety and return on investment.

Student recruitment events are popular and influential

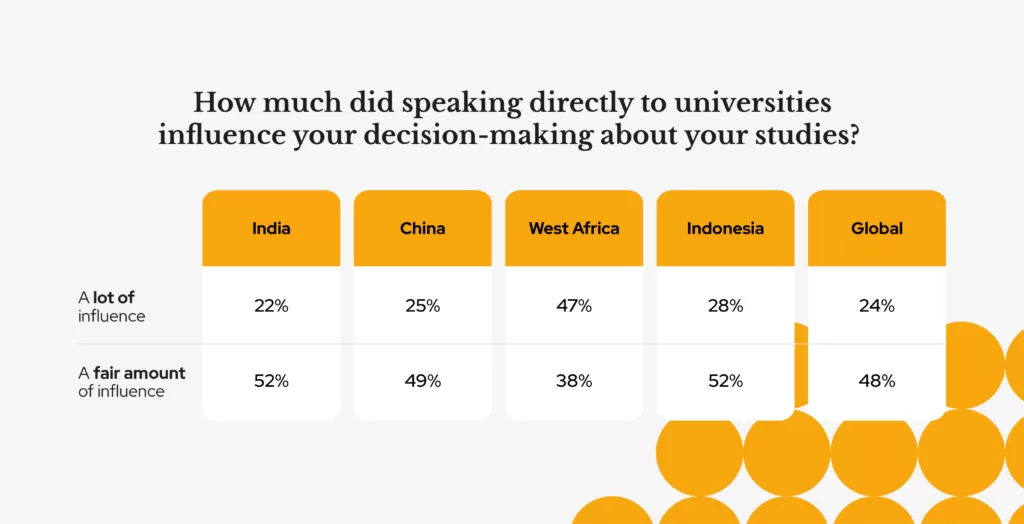

69% of Indonesian students have attended a student recruitment event – the highest in our four reports. 52% and 50% of Indian and Chinese students respectively have attended a student recruitment event; 46% of West African students attended an event – just below the global average of 50%.

Importantly, those that attend events find them influential.

Using student recruitment events is a key channel for institutions looking to grow their international student numbers.

Key recommendations

- Promote return on investment for your students – cost of living is a near-global concern. Assuage concerns by highlighting the value of a degree from your institution.

- Connect existing students with prospective students – a high proportion of students cited existing students as useful sources of information. Facilitate connection through peer-to-peer platforms, or invite alumni to student recruitment events.

- Create materials that resonate with parents – parents have significant influence on international student decision making. They must be considered as a key audience, whether that’s enabling students to effectively articulate your institution’s proposition, or creating marketing collateral tailored to parents’ interests.

- Maximise presence at student recruitment events – as a low cost, high impact option, student recruitment events present a real opportunity for universities to generate new leads and influence student decision-making.

- Consider push and pull factors of students on a per country or regional basis – Use these insights to tailor your marketing and recruitment plans.

Explore how QS can help improve your student recruitment – from consulting on strategy to application processing.