Using data from the QS International Student Survey 2023, third party data, and submissions from leading business schools, a new QS report explores graduate management education trends.

Titled “Business school applicant trends and motivations in 2024” the report is designed to help the higher education sector better understand the business education landscape through international applicant perspectives.

Much like our regional snapshot on the Asia Pacific region last week, we’re taking a brief look at the trends European business schools are seeing in their applicants – the full report is available now.

Why do students choose European business schools?

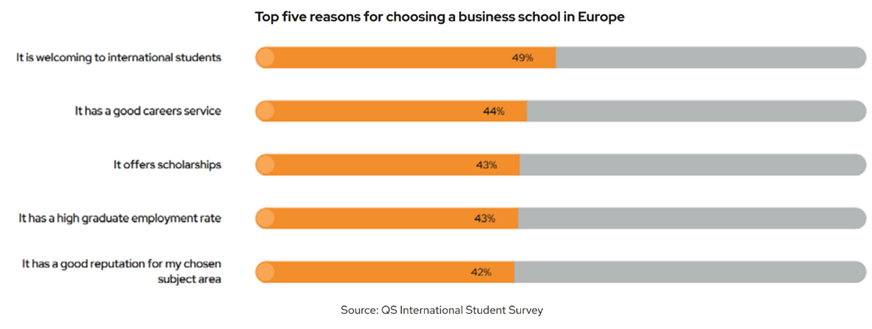

According to the survey, international applicants seeking study options in European business schools highly prioritise a welcoming environment (49%) and a good careers service (44%). Additionally, scholarships closely align with a high graduate employment rate – both valued at 43%.

Applicants to courses in Europe also place significant importance on the international orientation of the programme, reflecting Europe’s diverse and interconnected business landscape. The emphasis on global networks and cross-cultural competencies is seen as crucial for thriving in a multinational business environment.

What is the key factor influencing students to study a GME degree in the UK?

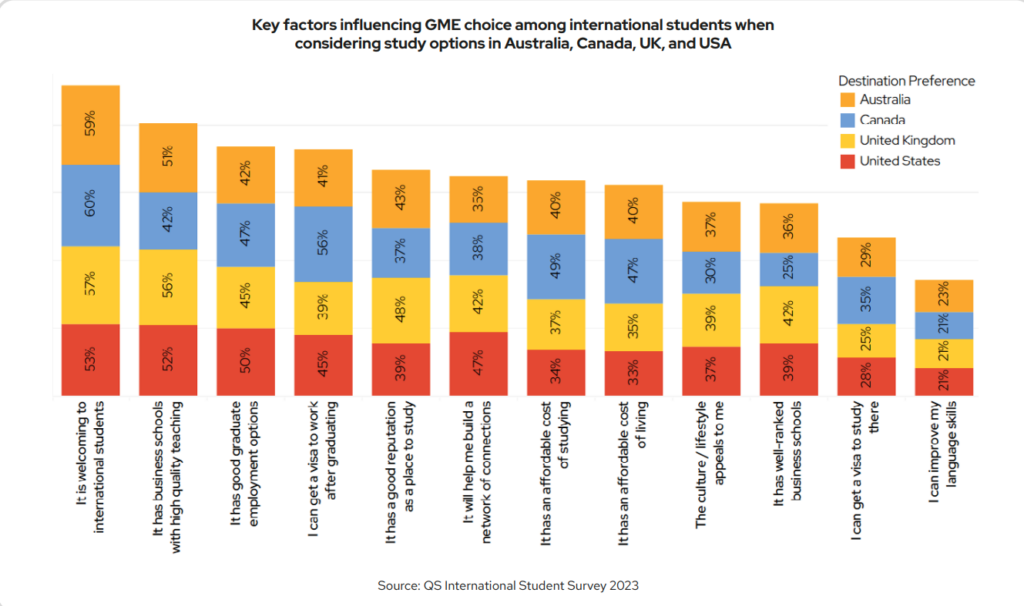

The quality of teaching remains a crucial factor, with the UK leading (56%) compared to its counterparts. Notably, while teaching quality ranks highest, post-graduation visas emerge as the lowest priority among international students considering study options in the UK – indicating that staying for work holds less significance for UK applicants.

International applicants choosing the UK are increasingly self-funded

MBA programmes in the UK rely heavily on international students. On average 90% of UK MBA enrollments are international students.

The landscape of MBA programme funding in the UK has shifted. A business school from Northern England observed that during COVID-19, there was a decrease in applications from company-sponsored candidates due to cost-cutting measures.

“The overall volume of applications dropped somewhat in the past 12 (2022-2023) months, though conversations within my network of colleagues at other business schools suggests that this is an industry-wide trend.”

Liam Kilby, Associate Director of MBA Recruitment and Admissions at Saïd Business School, University of Oxford

However, according to the QS report the decline in applications from these specific applicants was offset by a rise in self-funded students applying to their programmes.

This trend suggests a potential rise in entrepreneurial pursuits among UK business school graduates. In 2022, QS recorded that on average, six percent of graduates from UK based MBA programmes went on to establish their own businesses, highlighting the entrepreneurial spirit of UK business school graduates. This change in the funding source for MBA students could be a driving factor in fostering a new wave of entrepreneurs emerging from UK business schools.